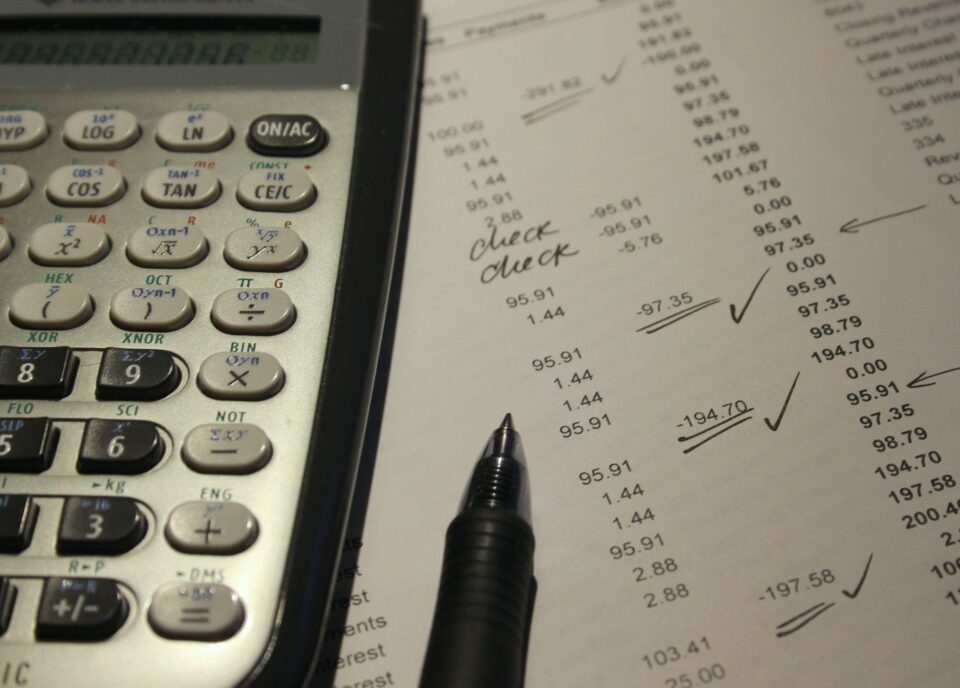

Accountants and Auditors

At a glance

- Median Salary$68,685

- Local Jobs1,507

Occupation Profile

By the Numbers

Median annual earnings$68,685

Median Annual Earnings are the midpoint earned by 50 percent of workers who are the lowest paid and 50 percent of workers who are the highest paid in a particular occupationLocal Jobs1,507

Median Annual Earnings are the midpoint earned by 50 percent of workers who are the lowest paid and 50 percent of workers who are the highest paid in a particular occupationEntry-level educationBachelor's Degree

Median Annual Earnings are the midpoint earned by 50 percent of workers who are the lowest paid and 50 percent of workers who are the highest paid in a particular occupation

Daily Tasks

- Prepare detailed reports on audit findings.

- Report to management about asset utilization and audit results, and recommend changes in operations and financial activities.

- Collect and analyze data to detect deficient controls, duplicated effort, extravagance, fraud, or non-compliance with laws, regulations, and management policies.

- Inspect account books and accounting systems for efficiency, effectiveness, and use of accepted accounting procedures to record transactions.

- Supervise auditing of establishments, and determine scope of investigation required.

- Confer with company officials about financial and regulatory matters.

- Examine and evaluate financial and information systems, recommending controls to ensure system reliability and data integrity.

- Inspect cash on hand, notes receivable and payable, negotiable securities, and canceled checks to confirm records are accurate.

- Examine records and interview workers to ensure recording of transactions and compliance with laws and regulations.

- Prepare, examine, or analyze accounting records, financial statements, or other financial reports to assess accuracy, completeness, and conformance to reporting and procedural standards.

- Prepare adjusting journal entries.

- Review accounts for discrepancies and reconcile differences.

- Establish tables of accounts and assign entries to proper accounts.

- Examine inventory to verify journal and ledger entries.

- Analyze business operations, trends, costs, revenues, financial commitments, and obligations to project future revenues and expenses or to provide advice.

- Report to management regarding the finances of establishment.

- Develop, implement, modify, and document recordkeeping and accounting systems, making use of current computer technology.

- Evaluate taxpayer finances to determine tax liability, using knowledge of interest and discount rates, annuities, valuation of stocks and bonds, and amortization valuation of depletable assets.

- Examine whether the organization’s objectives are reflected in its management activities, and whether employees understand the objectives.

- Audit payroll and personnel records to determine unemployment insurance premiums, workers’ compensation coverage, liabilities, and compliance with tax laws.

Occupational Skills

Hard Skills

- Accounting

- Accounting Software

- Accounts Payable

- Auditing

- Bookkeeping

- Finance

- Financial Statements

- General Ledger

- Generally Accepted Accounting Principles

- Internal Controls

Soft Skills

- Budgeting

- Communications

- Customer Service

- Detail Oriented

- Management

- Microsoft Excel

- Operations

- Planning

- Research

- Writing

Hard skills are specific, learnable, measurable, often industry- or occupation-specific abilities related to a position.

Soft skills can be self-taught and usually do not necessitate a certain completed level of education. They are essential in many industries and occupations.

Educational Programs

Accountants and Auditors

| Type | Credential | Hrs | Online | Financial Aid |

| Credit | AA Degree | 1056 | Yes | Yes |

Learn more aboutAccountants and Auditors

Visit Career Coach for additional in-depth information and available training programs for this job.